Table of Contents

- Introduction to online credit card payments

- Setting up an account for online payments

- Choosing a secure website for transactions

- Entering your credit card information

- Verifying your identity

- Completing the transaction

- Protecting your personal information

- Monitoring your credit card activity

- Disputing fraudulent charges

- Frequently Asked Questions (FAQ)

- Conclusion

Introduction to online credit card payments

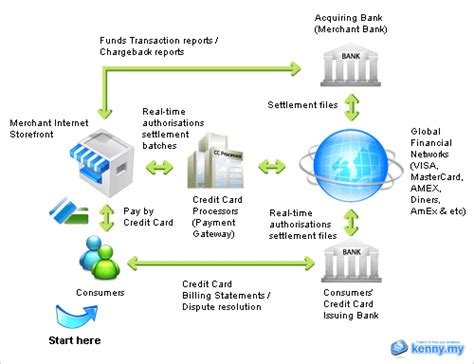

Online credit card payments have revolutionized the way we shop and pay for services. By using a credit card, you can make purchases from the comfort of your own home, without the need to carry cash or visit a physical store. Additionally, many credit cards offer rewards, such as cashback or points, which can add up to significant savings over time.

However, it’s essential to understand the process of paying online with a credit card to ensure that your transactions are secure and your personal information is protected. In the following sections, we’ll guide you through each step of the process.

Setting up an account for online payments

Before you can start making online payments with your credit card, you’ll need to set up an account with the merchant or service provider. This process typically involves providing some basic personal information, such as your name, email address, and shipping address (if applicable).

When setting up an account, it’s crucial to choose a strong, unique password to protect your information. Consider using a combination of uppercase and lowercase letters, numbers, and special characters, and avoid using easily guessable information like your birthdate or pet’s name.

Choosing a secure website for transactions

When making online payments, it’s essential to ensure that the website you’re using is secure. Look for the following indicators of a secure website:

- HTTPS: The website’s URL should begin with “https://” instead of “http://”. The “s” stands for “secure” and indicates that the website uses encryption to protect your information.

- SSL certificate: Look for a padlock icon in the address bar, which indicates that the website has an SSL (Secure Sockets Layer) certificate. This certificate ensures that the data transmitted between your browser and the website is encrypted.

| Indicator | What to look for |

|---|---|

| URL | https:// |

| Padlock | 🔒 |

If a website doesn’t have these security features, consider finding an alternative merchant or service provider to ensure the safety of your personal and financial information.

Entering your credit card information

When you’re ready to make a purchase, you’ll need to enter your credit card information. This typically includes:

- Credit card number: The 16-digit number on the front of your card.

- Expiration date: The month and year your card expires, usually formatted as MM/YY.

- CVV or CVC: The 3-digit security code on the back of your card (4 digits on the front for American Express).

- Name on the card: The name exactly as it appears on your credit card.

Double-check that all the information you’ve entered is correct before proceeding to the next step.

Verifying your identity

Some websites may require additional steps to verify your identity before processing your payment. This is to protect both you and the merchant from fraudulent transactions. Common verification methods include:

- Address Verification System (AVS): This system compares the billing address you provided with the address on file with your credit card issuer.

- 3D Secure: This is an additional layer of security that requires you to enter a password or a one-time code sent to your phone to complete the transaction.

These verification steps may add a little extra time to the payment process, but they’re essential for protecting your financial information.

Completing the transaction

Once you’ve entered your credit card information and verified your identity (if required), you can complete the transaction by clicking the “Submit” or “Pay” button. After the payment is processed, you should receive a confirmation message or email from the merchant or service provider.

It’s a good idea to save or print a copy of this confirmation for your records, in case there are any issues with the transaction later on.

Protecting your personal information

When paying online with a credit card, it’s crucial to take steps to protect your personal and financial information. Here are some tips to help keep your data secure:

- Use strong, unique passwords for each online account

- Avoid saving your credit card information on websites or in your browser

- Only shop on secure websites with HTTPS and SSL certificates

- Be cautious of phishing scams and suspicious emails requesting your personal information

- Regularly monitor your credit card statements for unauthorized charges

By following these best practices, you can minimize the risk of your information falling into the wrong hands.

Monitoring your credit card activity

After making an online payment, it’s essential to monitor your credit card activity to ensure that there are no unauthorized charges. Most credit card issuers offer online portals or mobile apps that allow you to easily view your transactions and account balance.

Make it a habit to review your credit card statements regularly, preferably once a week or at least once a month. If you notice any suspicious activity, contact your credit card issuer immediately to report the issue.

Disputing fraudulent charges

If you discover fraudulent charges on your credit card, you have the right to dispute them with your credit card issuer. The process for disputing charges may vary depending on your issuer, but generally, you’ll need to:

- Contact your credit card issuer as soon as possible to report the fraudulent charges.

- Provide any relevant information or documentation to support your claim, such as receipts or confirmation emails.

- Your issuer will investigate the charges and may temporarily remove them from your account during the investigation.

- If the charges are found to be fraudulent, they will be permanently removed from your account, and you won’t be held responsible for them.

It’s important to note that most credit card issuers have zero liability policies, which means you won’t be held responsible for fraudulent charges as long as you report them promptly.

Frequently Asked Questions (FAQ)

1. Is it safe to pay online with a credit card?

Paying online with a credit card is generally safe, as long as you take the necessary precautions to protect your personal and financial information. This includes shopping on secure websites, using strong passwords, and regularly monitoring your credit card activity.

2. What should I do if I notice unauthorized charges on my credit card?

If you notice unauthorized charges on your credit card, contact your credit card issuer immediately to report the issue. They will guide you through the process of disputing the charges and will investigate the matter to determine if the charges are indeed fraudulent.

3. Can I save my credit card information on a website for future purchases?

While saving your credit card information on a website can be convenient for future purchases, it’s generally not recommended. If the website experiences a data breach, your credit card information could be compromised. It’s safer to enter your credit card information manually for each transaction.

4. What is the difference between a credit card and a debit card when paying online?

The main difference between using a credit card and a debit card when paying online is the level of protection offered. Credit cards typically have more robust fraud protection and zero liability policies, which means you won’t be held responsible for fraudulent charges. Debit cards, on the other hand, are directly linked to your bank account, and fraudulent charges could lead to your funds being temporarily unavailable.

5. Can I use a prepaid credit card to pay online?

Yes, you can use a prepaid credit card to pay online, as long as the card is accepted by the merchant or service provider. Prepaid credit cards can be a good option if you want to limit your spending or avoid using your regular credit card for online purchases.

Conclusion

Paying online with a credit card is a convenient and secure way to make purchases and pay for services in today’s digital age. By understanding the process, taking necessary precautions to protect your personal information, and regularly monitoring your credit card activity, you can enjoy the benefits of online payments while minimizing the risk of fraud.

Remember to always shop on secure websites, use strong passwords, and be cautious of phishing scams. If you notice any suspicious activity on your credit card, don’t hesitate to contact your issuer to report the issue and dispute any fraudulent charges.

By following the tips and best practices outlined in this guide, you can confidently and safely use your credit card for online payments (PayOnlineCC), making your shopping and service-purchasing experience more convenient and rewarding.

No responses yet